COMPOUND INTEREST PROBLEMS

Problem 1 :

$800 is invested in compound interest where the rate of interest is 20% per year. If interest is compounded half yearly, what will be the accumulated value and compound interest after 2 years?

Solution :

The formula to find accumulated value in compound interest is

A = P(1 + r/n)nt

A ----> Accumulated value (final value)

P ----> Principal (initial value of an investment)

r ----> Annual interest rate (in decimal)

n ----> Number of times interest compounded per year

t ----> Time (in years)

Here,

P = 800

r = 20% = 0.2

n = 2

t = 2

Then, the accumulated value is

A = 800(1 + 0.1)4

A = 800(1.1)4

A = 800 ⋅ 1.4641

A = $1171.28

Compound interest is

= A - P

= 1171.28 - 800

= $371.28

Problem 2 :

A sum of money placed at compound interest doubles itself in 3 years. In how many years will it amount to four times itself?

Solution :

Let P be the amount invested initially.

From the given information,

P becomes 2P in 3 years

Because the investment is in compound interest, the principal in the 4th year will be 2P.

And 2P becomes 4P (it doubles itself) in the next 3 years.

Therefore, at the end of 6 years accumulated value will be 4P.

So, the amount deposited will amount to 4 times itself in 6 years.

Problem 3 :

The compound interest and simple interest on a certain sum for 2 years is $ 1230 and $ 1200 respectively. The rate of interest is same for both compound interest and simple interest and it is compounded annually. What is the principle?

Solution :

Simple interest for two years is 1200 and interest for one year is 600.

So, compound interest for 1st year is 600 and for 2nd year is 630.

(Since it is compounded annually, simple interest and compound interest for 1st year would be same)

When we compare the compound interest for 1st year and 2nd year, it is clear that the interest earned in 2nd year is 30 more than the first year.

Because, interest 600 earned in 1st year earned this 30 in 2nd year.

It can be considered as simple interest for one year.

That is, principal = 600, interest = 30.

I = Prt/100

30 = (600 ⋅ r ⋅ 1)/100

30 = 6r

5% = r

In the given problem, simple interest earned in two years is 1200.

I = Prt/100

1200 = (P ⋅ 5 ⋅ 2)/100

1200 = P/10

Multiply each side by 10.

12000 = P

So, the principal is $ 12,000.

Problem 4 :

Mr. David borrowed $15,000 at 12% per year compounded annually. He repaid $7000 at the end of 1st year. What amount should he pay at the end of second year to completely discharge the load?

Solution :

The formula to find accumulated value in compound interest is

A = P(1 + r/n)nt

To find the accumulated value for the first year,

Substitute P = 15000, r = 0.12, n = 1 and t = 1 in the above formula.

A = 15000(1 + 0.12/1)1x1

= 15000(1 + 0.12)1

= 15000(1.12)

= 16800

Amount paid at the end of 1st year is 7000.

Balance to be repaid :

= 16800 - 7000

= 9800

This 9800 is going to be the principal for the 2nd year.

Now we need the accumulated value for the principal 9800 in one year. (That is, at the end of 2nd year)

A = 9800(1 + 0.12/1)1x1

= 9800(1 + 0.12)1

= 9800 ⋅ 1.12

= 10976

So, to completely discharge the loan, at the end of 2nd year, Mr. David has to pay $ 10,976.

Problem 5 :

There is 60% increase in an amount in 6 years at simple interest. What will be the compound interest of $12,000 after 3 years at the same rate?

Solution :

Let the principal in simple interest be $100.

Since there is 60% increase, simple interest = 60

We already know the formula for S.I.

That is,

I = Prt/100

Here, I = 60, P = 100, t = 6.

60 = (100 ⋅ r ⋅ 6)/100

60 = 6r

Divide each side by 6.

10% = r

Because the rate of interest is same for both S.I and C.I, we can use the rate of interest 10% in C.I.

To know compound interest for 3 years,

Substitute P = 12000, r = 0.1, n = 1 and t = 3 in the formula of C.I.

A = 12000(1 + 0.1/1)1x3

= 12000(1 + 0.1)3

= 12000(1.1)3

= 12000(1.331)

= 15972

Compound interest = A - P

= 15972 - 12000

= 3972

So, the compound interest after 3 years at the same rate of interest is $3972.

Kindly mail your feedback to v4formath@gmail.com

We always appreciate your feedback.

©All rights reserved. onlinemath4all.com

Recent Articles

-

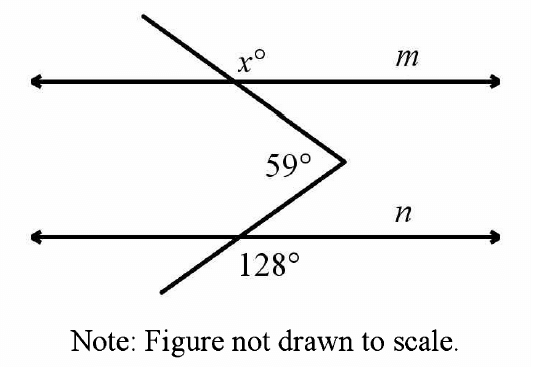

Digital SAT Math Problems and Solutions (Part - 143)

Apr 13, 25 12:01 PM

Digital SAT Math Problems and Solutions (Part - 143) -

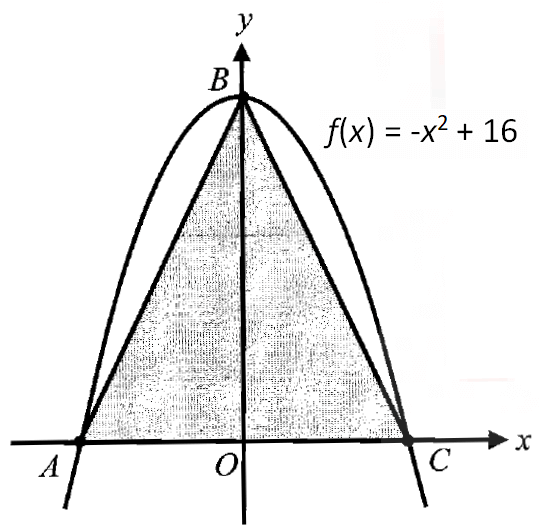

Quadratic Equation Problems with Solutions

Apr 12, 25 08:21 PM

Quadratic Equation Problems with Solutions -

Digital SAT Math Problems and Solutions (Part - 142)

Apr 11, 25 06:26 PM

Digital SAT Math Problems and Solutions (Part - 142)